Upgrade launched its first mobile banking platform Thursday, a product co-founder and CEO Renaud Laplanche said will complement and drive further growth to the fintech’s credit and lending offerings.

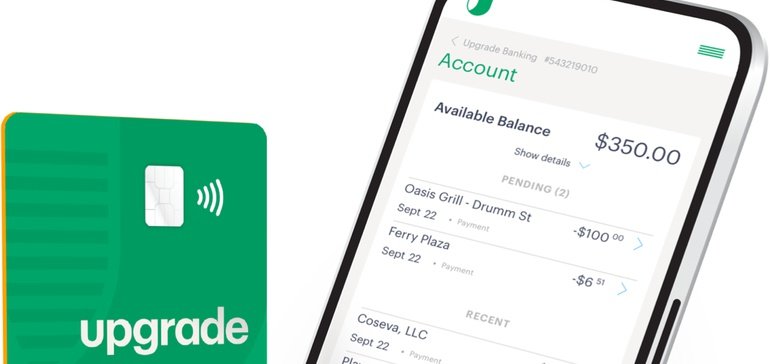

The fee-free checking account comes with a debit card that allows customers to earn 2% cash back on common expenses such as gas, groceries and recurring payments, and 1% cash back on all other debit charges. Qualifying customers that open bank accounts with Upgrade can also get up to 20% lower rates on the company’s loans.

Cross River Bank is providing the banking services for Upgrade’s digital checking account.

Laplanche, who founded San Francisco-based fintech LendingClub in 2006 before launching Upgrade in 2017, said the new digital banking platform won’t be a revenue driver but rather an offering that will bring new customers to Upgrade’s personal loan and credit products.

Through direct deposit, Laplanche said Upgrade has better visibility into a customer’s expense patterns, which translates into lower rates on personal loans and credit cards for mobile banking customers.

“We can more easily calculate free cash flow and their ability to repay the loan,” he said. “Mobile banking for us is both a way to deliver more value to existing customers, and also to acquire new customers.”

One million customers apply for Upgrade loans each month Laplanche said, and customers that don’t qualify will now be encouraged to open accounts.

“Those who we decline, we tell them, ‘Maybe we can’t give you a loan or credit card right now, but you should open an account with us for direct deposit so we can get to know you better,'” he said.

Laplanche said the 2% cash back feature of Upgrade’s new debit card is meant to incentivize customers to use debit for common expenses.

“The kind of rewards you get on credit cards and not on debit cards gives the wrong incentives to consumers. A lot of people use that credit on expenses where they should be using their debit cards, and then end up carrying that balance on the card, getting into debt for no good reason,” he said.

Laplanche said the company saw 75% growth last year, compared to 2019, despite the pandemic.

“We were expecting a lot of defaults on our loans, but pretty quickly we realized that our customer base ended up pretty well off. People have stable employment,” Laplanche said.

The average Upgrade customer is 42 years old with an income around $90,000 and a credit score of about 700, Laplanche said.

“We’re at a point where we’re doing about $150 million in annual revenue. We’re profitable,” he said. “That really puts us in a great place to accelerate with mobile banking in 2021. We’re planning to more than double this year.”

Upgrade quietly launched auto loan refinancing a couple of months ago, a product the company is slowly ramping up, Laplanche said.

Read More..