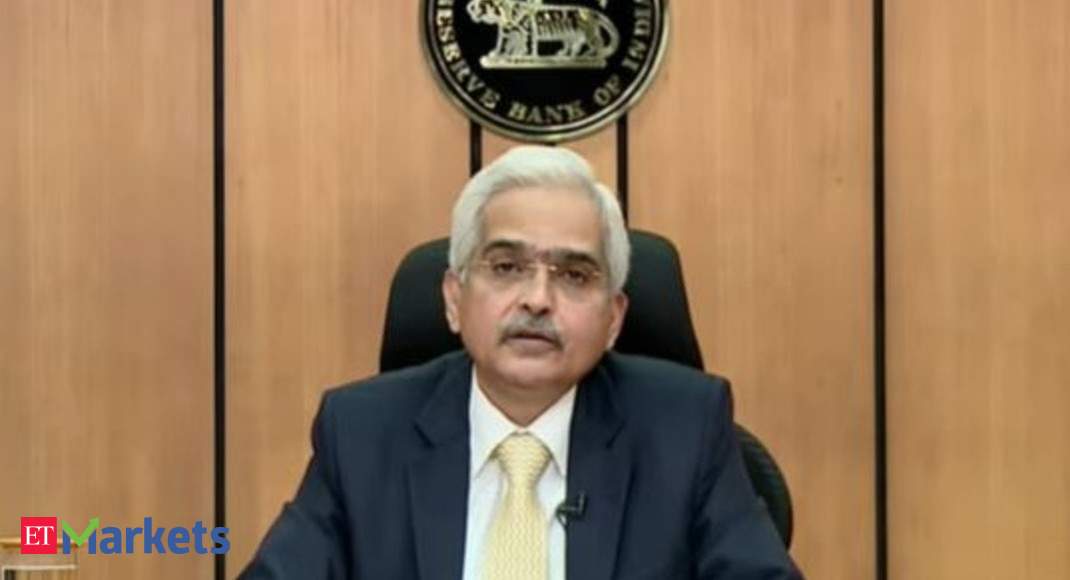

NEW DELHI: The Reserve Bank of India has outlined three challenges when it comes to improving the financial inclusion infrastructure in India, Governor Shaktikanta Das said on Thursday.

The parameters outlined by Das were the identification of the customer, reaching the last mile and providing relevant, affordable and safe products.

“The digital ID (Aadhaar) along with the proliferation of mobile phones with world class payment systems have addressed the first two challenges of access and usage to a large extent,” Das said at the Economic Times Financial Inclusion Summit 2021 today.

“The third challenge i.e. quality requires both demand and supply side interventions,” the Governor said.

A copy of the speech was uploaded on the RBI‘s website shortly after Das spoke.

While the opening of Pradhan Mantri Jan-Dhan Yojana accounts has enabled millions of Indians with access to financial products, the steps taken on the demand side are aimed at increasing public awareness, Das said.

According to Das, the banking regulator’s focus for increasing sustainable financial inclusion is targeted on three areas — financial literacy, customer protection and mechanisms for grievance redressal.

“Setting up of National Centre for Financial Education (NCFE) by the Regulators and implementation of the Centre for Financial Literacy (CFL) project of RBI are two recent initiatives towards improving financial literacy,” the Governor said.

Das today emphasised the crucial role played by payment systems in the economy, saying that these are increasingly being recognized as a means to ensure that economic benefits percolate to the bottom of the pyramid.

He pointed out that the number of Prepaid Payment Instruments had increased at a compounded annual growth rate of 53 per cent from 41 crore rupees in May 2017 to 226 crore rupees in May 2021.

The Governor said financial inclusion would remain a policy priority so as to make the recovery from the coronavirus pandemic more inclusive and sustainable.

He also lauded the role played by microfinance companies bridging last mile gaps and said that in keeping with this a consultative document for harmonising various regulatory frameworks in the microfinance space had been recently issued.

Another step announced by Das today was the creation and periodic dissemination of a Financial Inclusion Index with three parameters – access, usage and quality.

“Work on FI Index is underway and the Index will be published shortly by RBI,” Das said.

Source : From the Web