Often when the subject of innovation and having a strategy for promoting change is brought up, skeptics say, “Isn’t like trying to bottle lightning?”. This jives with the popular idea of innovation; lightning strikes the lone genius sequestered in the garret, they come down from on high clutching the tablets of change which when read aloud and popularized, changes the course of humanity. Ben Franklin was never struck by lightning. Franklin, of the famous kite-lightning experiment, was lucky that lightning never struck his kite, or he would have been frizzled and fried to a crisp and not in any shape to midwife the constitution about 25 years later.

Collaboration was key, as Franklin was the creator of junto, a discussion group for issues of the day, in Philadelphia. Franklin and his collaborators generated new insights through discussion and debate. Franklin spread these ideas and inventions through news columns which he wrote under multiple pseudonyms. Communication and openness were the key to success. If he were alive today, Ben Franklin would have been a member of the open source movement, he would probably also have had a billion twitter followers. Franklin wrote “That, as we enjoy great advantages from the inventions of others, we should be glad of an opportunity to serve others by any invention of ours; and this we should do freely and generously.”

Satoshi Nakamoto would have agreed with Franklin. Banks and financial institutions have been adherents of the antithesis of this sentiment. They infamously concern themselves with IP even when they had no IP to protect. For many years they took more than they gave. Times are changing, financial institutions are at last joining together to collaborate, this is the only way to transform markets and market infrastructure; since the very word market conjures up togetherness in a venue. What will propel their change is a cultural transformation of financial institutions. With the ever present threat of disruption by big tech and fintechs and the changing of ways due to the enforced distancing and remote working due to COVID, big financial institutions all over the world are more ripe for change this year.

Set up your Digital APIX bank!

In Asia, China has taken digital transformation and self-reliance very seriously. This is why they have multiple programs to knit together financial infrastructure, mostly spearheaded by state institutions like the blockchain-based service network (BSN), an interoperability framework. BSN is also being launched internationally; however it will be controlled by the state; as that is the current culture of China.

This is the same idea behind the India Stack, a common substrate that enforces standards and rules for basic utilities like digital identity, digital storage for documents, payment infrastructure and other capabilities. It has already dramatically increased financial inclusion and removed obstacles to data portability and user sovereignty.

MORE FOR YOU

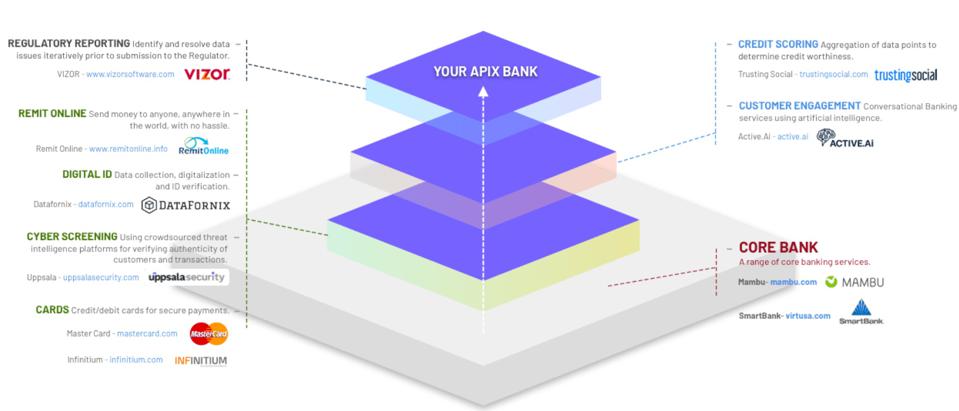

Elsewhere in Asia, the ASEAN Financial Innovation Network (AFIN) established in 2018 by the ASEAN Bankers Association (ABA), the World Bank, and the Monetary Authority of Singapore (MAS) has launched the API Exchange (APIX). Cross-border collaboration between FinTechs and financial institutions can happen inside APIX which is an open API marketplace and sandbox platform. AFIN’s mission is to increase innovation through cooperation. This is the whole idea of co-opetition; the idea that once a basic layer and structure for interoperation is created, competition can happen in the higher layers. Instead of an uneasy partnership with FinTechs worked through on a bilateral basis; the terms of engagement, labs and sandboxes are pre-solved on a collaborative basis. Approvals and agreements previously done on a piecemeal basis, which take months to sign, followed by months of setting up infrastructure to do proof of concepts or minimum viable products can now be done in a very short period of time. This is the whole idea behind APIX.

According to management gurus, the success of platforms come from openness, attracting developers, evangelizing the platform, sharing the spoils and creating network effects. However, the gurus are normally talking about single enterprise platforms like Alibaba

One thing common between single enterprise platforms and meta-platforms is the degree of education and evangelization necessary to attract different types of participants. Users, in this case Fintechs and Financial Institutions and ultimately their customers, and the employees of the enterprises should be the targets. OXYGEN, an initiative under APIX will bring together thought leaders, practitioners and experts thru events, debate forums, research white papers, podcasts, to evangelize and educate. OXYGEN will launch at the Singapore Fintech week, December 7th to 14th.

Read More…