Now that the vaccines for the deadly Covid-19 virus are in place, there is expected relief all over. The big question in the minds of most is how quickly will America get back on its feet? This is a fair questions, but the answers may not be straight forward. At least if we go by extant data.

Two important data published recently may provide us some insights on the recovery. It is worth examining them in a bit of detail.

Firstly, data published by the Federal Reserve (December 21st 2020) from the findings in the Survey of Consumer Expectations (SCE) Credit Access Survey 1 points to some key consumer behavior patterns that may impact recovery of US economy.

While the overall credit outstanding ( borrowings) remained steady, revolving balances declined by $5.5 billion. It is worth noting however, that the decline in revolving balances had started much earlier – in Q2 of 2020 with the onset of the pandemic.2 The decline was broad-based across various sections of society.

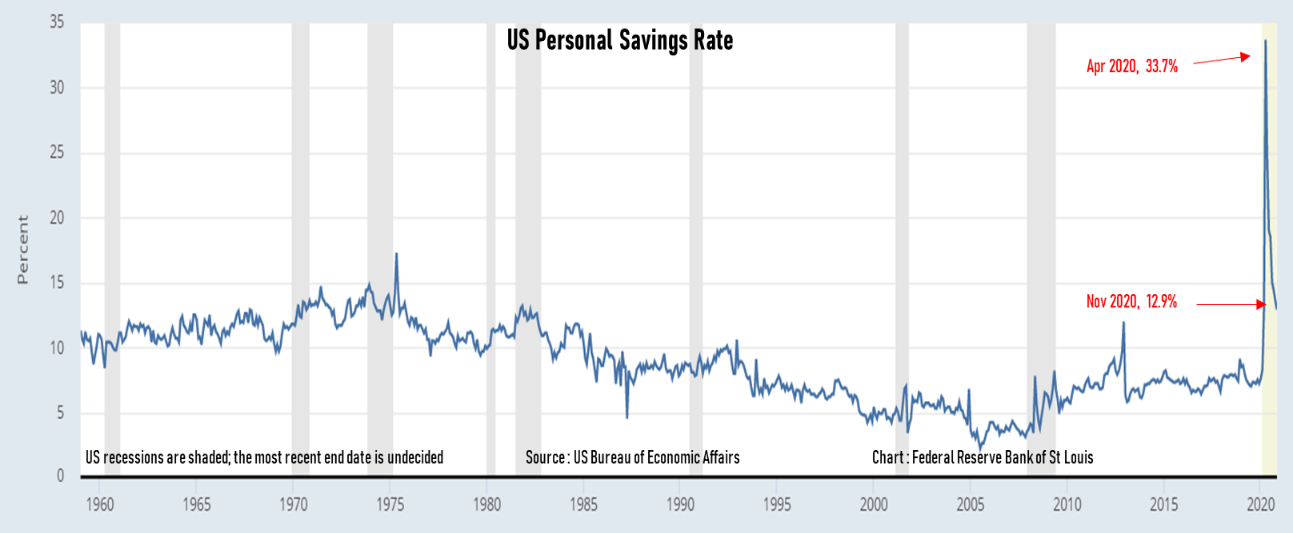

The second piece of data that is of interest is the US savings rate issued by the US Bureau of Economic Affairs (BEA). The BEA defines personal saving rate as personal saving as a percentage of disposable personal income. In other words, it’s the percentage of people’s incomes left after they pay taxes and spend money.

US savings rate was at a high of 12.9%, down from a never before seen high of 33.7% in April 2020. This has been attributed to lockdown of the economy which forced people to save.

The high savings rate definitely holds out hope of a hyper recovery. Given their proclivity to spend and live for the day rather than save for the uncertain future, Americans are more likely to splurge the savings at the first opportunity. This may figuratively be the equivalent of the bursting of reservoir or a dam, and could come with all attendant benefits as well as collateral damages. Having said that, the thinning of savings rate will largely be dependent of resumption of business and complete end of lockdowns.

However, we must be alert to the fact that this also hides a dramatic polarization of economic fortunes among Americans that we witness today. The truth is that the lucky ones with jobs have garnered higher savings and consequent increase in wealth while the unemployed continue to face hardships.3

The moot question then is what are the insights that these key data items offer us vis-a-vis the US economic recovery?

The decline in borrowings may be good news for the borrowers, but is definitely a bitter pill for the banks. This is because lower loan balances and fewer new accounts (loans , credit cards etc.) mean lower profits and could impact the bottom line of banks as early as H2 of 2021.

Further, as is well known, consumer spending is the engine of the US economy. If savings rate stay stagnant at these level or decrease at a slower pace , it could adversely impact consumer spending. Lower consumer spend , as a consequence of lockdown 2.0, will continue to put pressure on key economic sectors like restaurants, hospitality, travel and other related segments at are already enervated.

While US unemployment rate at 6.7% is indeed welcome news, it does not in any way mitigate the wealth inequalities or the hardships that the pandemic had already wreaked and continues to heap on the unemployed.4 The pall of gloom over these sections may continue well into 2021, even after they are gainfully employed.

Certainly, data cited above proffers mixed signals and may point to a turbulent recovery at the very minimum. While the availability of vaccines and inoculation of large sections of society will certainly improve the public health scenario and open up America sooner, it may not be a guarantee for business as usual.

The pandemic would still have left its indelible impressions, creating fissures via unprecedented income inequalities in a society that has already been scarred and deeply polarized by politics, race and massive economic divide.

A sputtered recovery can have a domino effect on the world economy at large. From trade to respective bilateral relations there could be tensions all because the pandemic left the world economy in tatters.

That brings the focus on the stimulus 2.0. The stimulus has be substantive and catalyze the bridging of the economic divide that prevails in the US today. That presupposes Congress will put a united foot forward and keep the nation’s interest first, rather than expedient political gains.

Both the Republicans and the Democrats have an incumbent duty to see this happen. The cost of failure could be a missed opportunity to resuscitate the US economy.

The data is what it is but its interpretations are subjective. It is for the political leadership to act with agility to bridge the economic chasm and jumpstart an effete economy. For their part the rest of the world will watch as bystanders hoping that the US rebounds and offer their economies a fighting chance to recover from the devastation of the pandemic.

References

1. Credit Access Survey Shows Plunge in Credit Demand and Access – FEDERAL RESERVE BANK of NEW YORK (newyorkfed.org)

2. Consumer Loans: Credit Cards and Other Revolving Plans, All Commercial Banks (CCLACBW027SBOG) | FRED | St. Louis Fed

3. The Pandemic Has Resulted in Record U.S. Savings Rates, but Only for Some

4. The Employment Situation — NOVEMBER 2020 (bls.gov)

#USEconomy #Pandemic #Recovery #ConsumerCredit