Bitcoin (BTC/USD) Analysis

Key Highlights

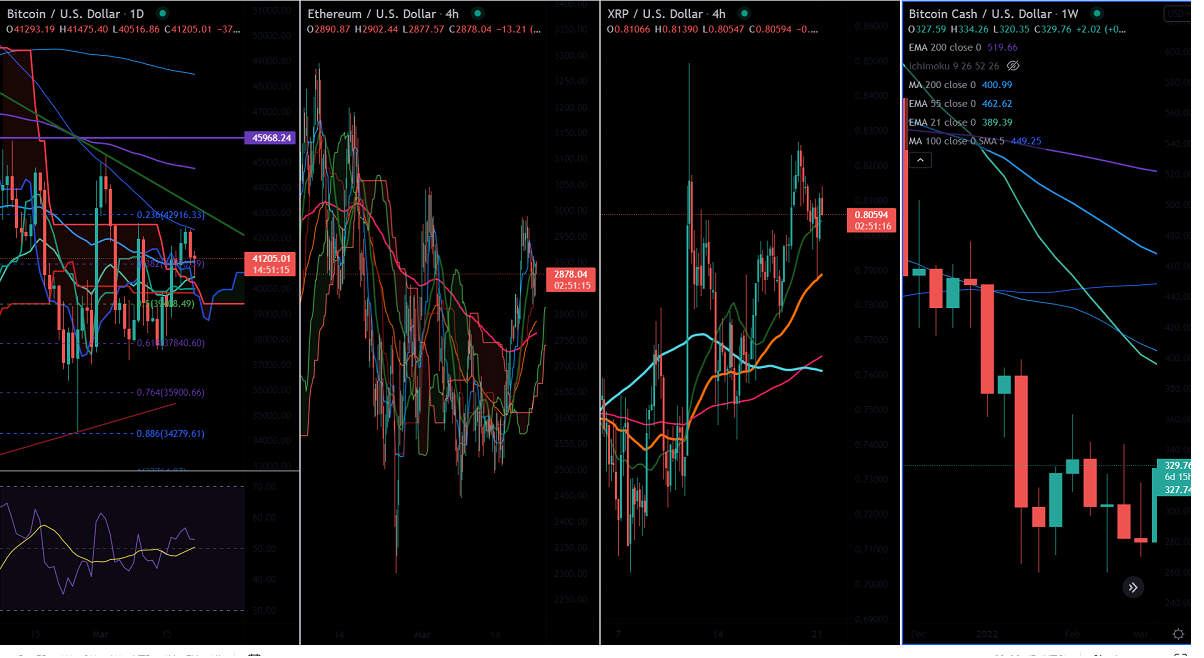

BTC’s price has once again declined after a minor jump above $42,000. It is still in the consolidation phase between $45,850 and $34,324 with a bullish bias. The pair is trading within the symmetric triangle and bullish sentiment will continue if it breaks $43,300 (breaking out of the triangle).

Technical Analysis

Intraday trend – Bullish

On the daily chart, the pair is trading above Tenken-sen ($39,986), Kijun-sen ($39,828), and above Ichimoku Kumo cloud ($40,817). It hits a high of $41,457 at the time of writing and is currently trading around $41,319.80.

Major support is seen at $40,500, any drop below this level confirms minor weakness. A dip till $37,000 (Mar 7th low)/$34,000/$32,950 (Jan 24th low)/$30,000/$28,600 is likely.

The immediate resistance is around $42,600 (Mar 9th high), any breach above that level confirms further bullishness. A jump to $45,356 (200-day EMA)/$50,000 is possible.

TradingView

RSI – Neutral

One strategy would be to buy on dips around $40,000 with SL around $37,000 for TP of $50,000.

ETH/USD Daily Outlook

Key Highlights

ETH/USD jumped to $2,988 due to lack of following through buying. It is currently trading around $2,882.98.

On the daily chart, the pair is trading above Tenken-sen ($2,740.95), Kijun-sen ($2,672), and below Ichimoku Kumo cloud ($3,026) confirming the neutral trend.

Major support is seen at $2,740. Any drop below this level confirms the bearish trend. A dip until $2,670/$2,600/$2,500/$2,445/$2,300 (Feb 24th low)/$2,150 is likely.

Bullish trend continuation may happen if Ethereum closes above $3,030. A jump to $3,300/$3,512 is possible.

RSI – Neutral

One option is to buy on dips around $2,750-60 with SL around $2,600 for TP of $3,500.

XRP/USD Outlook

Intraday trend – Bullish

Key support – $0.70, $0.50

Key Resistance – $0.86 (Mar 12th 2022)

XRP’S price in holding above short-term (55-day EMA) and long-term (200- day EMA) on the 4-hour chart; any breach above $0.860 would confirm bullish continuation. It is currently trading around $0.8055, with a short-term trend reversal only if it breaches $1.02 (23rd Dec high).

One strategy would be to buy above $0.860 with SL around $0.80 for a TP of $1.02.

BCH/USD Outlook

Intraday trend – Bullish

Key support – $300, $259

Key Resistance – $345

BCH/USD’s price is holding above the short-term (55-day EMA) and long-term (200-day EMA) on the 4-hour chart; any rise above $345 would confirm further bullishness. It is currently trading around $330.83; a short-term trend reversal only if it breaks $365.

One idea would be to buy on dips $300 with SL around $258 for a TP of $365/$400.

Bitcoin Support /Resistance

Resistance

R1- $42,600, R2- $43,500, R3- $46,000

Support

S1- $37,000, S2- $34,000, S3- $30,000

Ethereum Support/Resistance

Resistance

R1- $3,030, R2- $3,200, R3- $3,300

Support

S1- $2,740, S2- $2,670, S3- $2,600

See more at the Newsweek Cryptocurrency Index:

Getty Images

Read More…