FINANCING serves as an essential lifeline for micro, small and medium enterprises (MSMEs) as they need capital to expand production capacity, service a larger market, and hire additional staff.1 However, a perennial problem that MSMEs face is the difficulty of accessing finance. A major reason for this is that traditional financial institutions view MSMEs as risky borrowers due to the latter’s lack of collateral and other requirements to assess their creditworthiness.2 Instead, MSMEs rely on informal lending channels such as family, friends, and money lenders to finance their business operations.3

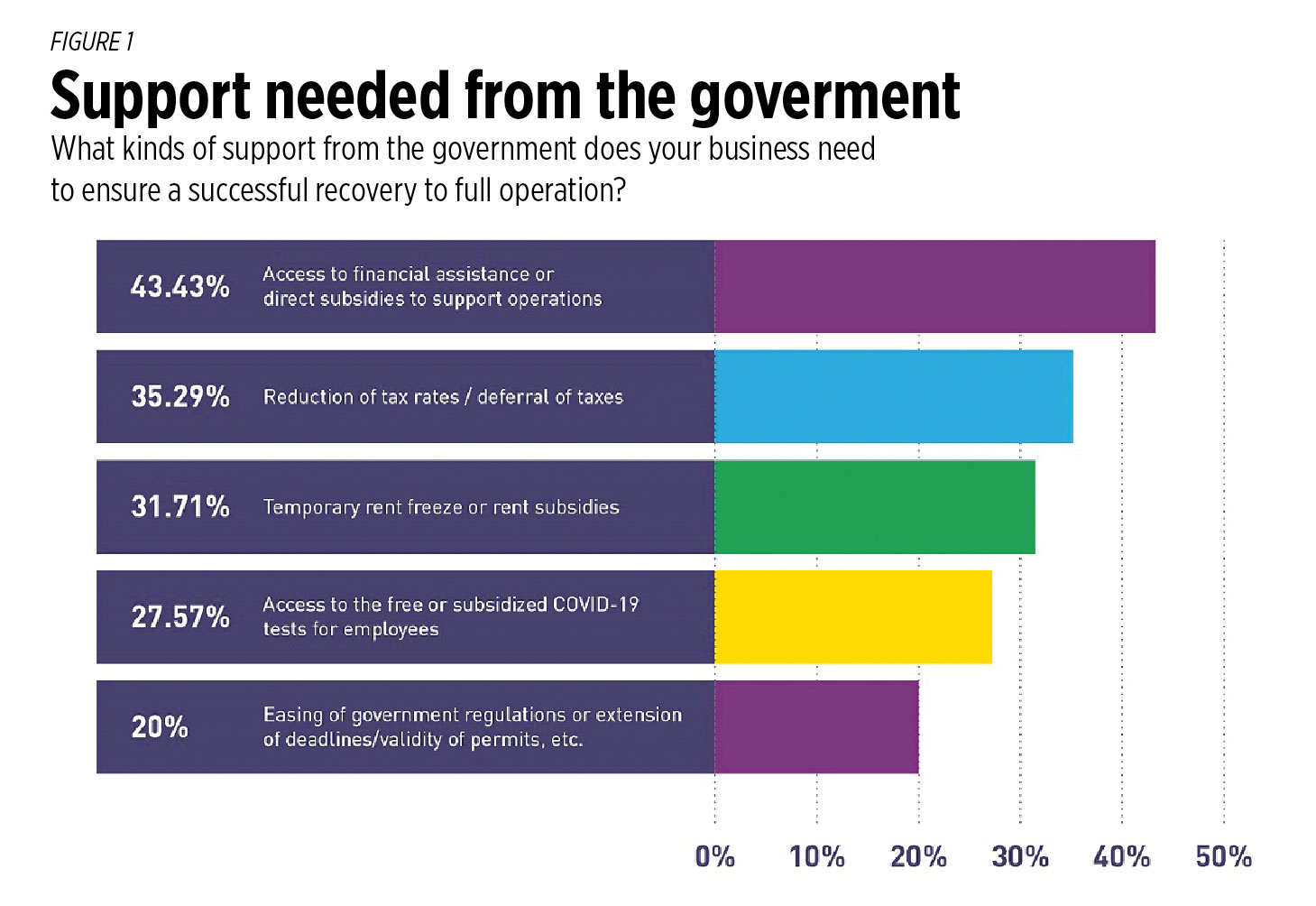

The burden of credit constraint becomes more pronounced for small businesses whenever a crisis occurs, such as the COVID-19 pandemic. The Asian Institute of Management RSN Policy Center for Competitiveness surveyed 700 MSMEs in Metro Manila and Calabarzon.4 The survey highlighted how MSMEs coped during the pandemic and their strategies for survival and building resilience. Over 43% of respondents expressed the need to receive access to financial assistance or direct subsidies to ensure a successful recovery to full operations (Figures 1 and 2), although the amount these MSMEs require is not necessarily large. Almost 69% of respondent firms said they needed less than P100,000 (roughly $2,000). This amount is relatively more substantial for micro-enterprises, who are typically more credit-constrained than their small or medium-sized counterparts.

The pandemic has transformed the way firms and customers conduct business. Since the onset of the crisis in March 2020, e-commerce platforms have seen an extensive usage increase. The shift to online shopping has been more pronounced in emerging and developing economies such as the Philippines. Even as economies navigate their way towards recovery, consumers are likely to continue embracing e-commerce, which is set to become more mainstream beyond the crisis.

In the age of quarantine restrictions and safe distancing, financial technology (fintech) companies can provide MSMEs with various financial services, from loans to digital payment solutions. Fintech democratizes finance and makes it more inclusive, which benefits small businesses and consumers alike.

Although the Philippines is a pioneer in e-commerce,5 launching its first digital payment platform Smart Money in 2001 and GCash in 2004, the use of mobile digital payment systems has been largely limited until the onset of the pandemic. The 65% increase6 in the number of customers using GCash from 20 million users in 2019 to 33 million users in 2020 indicates Filipinos’ willingness to embrace cashless transactions. As a conduit of financial inclusion, fintech platforms can encourage savings, extend much-needed credit, and promote digital financial literacy.

In response to increased demand for cashless and digital payments due to the pandemic, other countries have aggressively pursued fintech solutions as part of their business strategy.7 A study by Facebook and Small Business Roundtable found that 35% of MSMEs in the United States have adopted digital payment solutions.8 Singapore has aggressively promoted digital payment solutions to allow the safe and prompt reopening of their economy by encouraging the use of e-Invoicing and e-Payment, which enables businesses to provide e-receipts to customers and accept e-payments instead of paper receipts, cash, and checks.9

The speed and agility of fintech firms in being able to provide financial services to small businesses with limited credit history or collateral is especially needed for the quick recovery of MSMEs. Typically, fintech lenders assess the creditworthiness of MSMEs quicker than traditional banks by using analytics and other technologies.10 In Indonesia, financial inclusion is being promoted through peer-to-peer (P2P) lending using mobile apps such as Investree.11 and 12 Through participation in these P2P lending apps, SMEs were able to expand their business operations and increase their revenues.13

The widespread adoption of fintech has facilitated the recovery of small businesses in China, helping their economy bounce back.14 From being heavily reliant on cash transactions, China is now among the leading countries in digital payments, mainly through QR payment providers such as Alipay and WeChat Pay.15 By shifting directly to digital payments, China essentially leapfrogged card-based payments that Western countries such as the United States have long adopted.16 One way the two big QR payment providers enticed people to go cashless is by incorporating the traditional practice of giving angpaos or red envelopes with cash during Lunar New Year to their respective ecosystems. Instead of giving physical red envelopes to relatives and family members, they can now send digital red envelopes through these apps.17

The adoption of cashless payments is evident in urban areas in China and increasingly in rural areas. The proliferation of low-cost Chinese smartphones allows rural residents of China to access the internet for the first time. The expansion of internet access in rural areas and the Chinese state banks’ push towards opening bank accounts for rural residents lowers the barriers to entry in adopting QR payments and making financial inclusion more attainable.18 and 19 While the mobile penetration rate in the Philippines is high, several challenges remain, such as internet connectivity and financial literacy.

It is unclear how long the crisis will drag-on and what the next normal holds for small businesses in the Philippines, but fintech will play an important role in facilitating financial inclusion and ultimately helping MSMEs build resilience to future shocks. While fintech democratizes financial services for those who have access, policymakers should prioritize measures to enable the development of fintech and digital financial literacy to unlock the full potential of financial inclusion and help small businesses remain resilient to future crises.

1 https://www.poverty-action.org/sites/default/files/publications/English.pdf

3 ibid

4 https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3821248

5 https://www.gsma.com/mobilefordevelopment/programme/mobile-money/mobile-money-philippines-market-conditions-drive-innovation-smart-money-gcash-philippines-becoming-mobile-money-innovation-hub/#_ftn1

6 https://fintechnews.ph/44332/e-wallet/gcash-e-wallet-hits-php-1-trillion-in-transactions-in-2020/

7 http://www.fao.org/3/cb2109en/CB2109EN.pdf

8 https://dataforgood.fb.com/wp-content/uploads/2020/05/SMBReport.pdf

9 https://www.imda.gov.sg/programme-listing/smes-go-digital/Digital-Solutions-For-Safe-Reopening#billandpayonline

10 Kehinde, T. & Eksin, E. (May 12, 2020). How fintech can help SMEs recover from the impact of COVID-19. World Economic Forum. https://www.weforum.org/agenda/2020/05/fintech-can-help-smes-recover-covid-19/

11 Wardhani, N., & Bohmann, M. (Nov. 5, 2020). How fintech can help Indonesia’s small and medium enterprises survive the COVID-19 pandemic. The University of Queensland Research. https://research.uq.edu.au/article/2020/11/how-fintech-can-help-indonesia%E2%80%99s-small-and-medium-enterprises-survive-covid-19-pandemic

12 Eloksari, E.A. (July 3, 2020). P2P lending helps SMEs earn more, scale up business: Research. The Jakarta Post. https://www.thejakartapost.com/news/2020/07/03/p2p-lending-helps-smes-earn-more-scale-up-business-research.html

13 Ibid.

14 https://www.weforum.org/agenda/2020/05/digital-payments-cash-and-covid-19-pandemics/

15 https://www.asiapacific.ca/sites/default/files/publication-pdf/mobile_payment_report.pdf

16 https://www.brookings.edu/wp-content/uploads/2020/04/FP_20200427_china_digital_payments_klein.pdf

17 https://www.cgap.org/sites/default/files/researches/documents/Brief-Chinas-Alipay-and-WeChat-Pay-Dec-2017.pdf

18 https://www.asiapacific.ca/sites/default/files/publication-pdf/mobile_payment_report.pdf

19 https://www.cgap.org/sites/default/files/researches/documents/Brief-Chinas-Alipay-and-WeChat-Pay-Dec-2017.pdf

The views expressed in the article are the views of the authors and do not necessarily reflect the views or policies of the Asian Institute of Management (AIM).

John Paul Flaminiano is Associate Director and a Senior Economist at the AIM RSN Policy Center for Competitiveness. Christopher Ed Caboverde is a Research Associate at the AIM RSN Policy Center for Competitiveness.

Source : From the Web